Finding New Market Opportunities

Have you heard of the boiling frog syndrome? It goes like this: If you put a live frog in boiling water, it’ll jump out. But if you put a frog in regular water and then warm it up, it’ll get comfortable and slowly cook and die. It doesn’t realize that the environmental forces are changing against it as it likes the warmth and then it becomes too late to be able to respond.

Companies are not different. They build great stuff and grow but the environment and the market that’s helping drive their growth is also changing at the same time. It’s easy to forget that while the growth is going well, and then it gets too late to be able to respond.

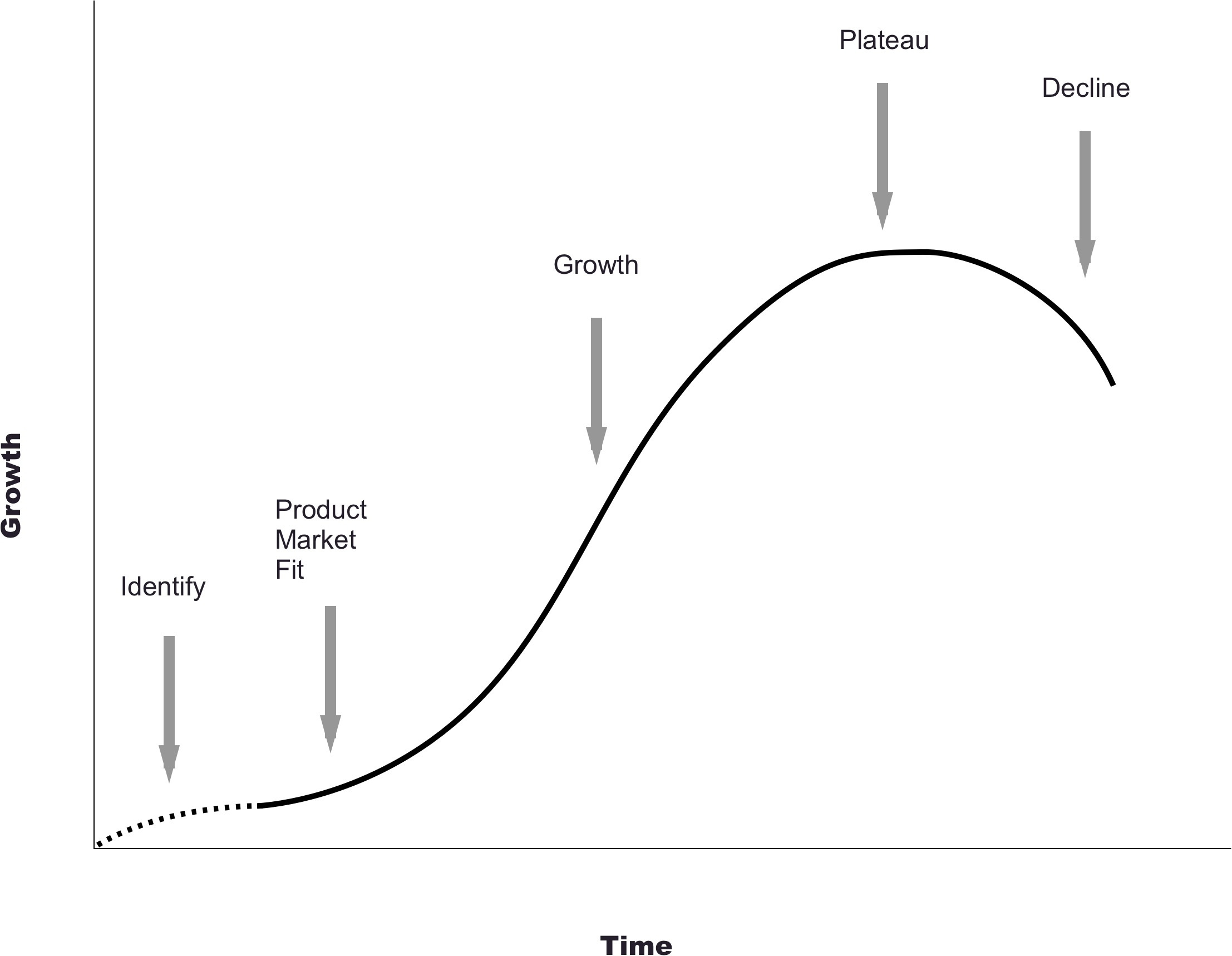

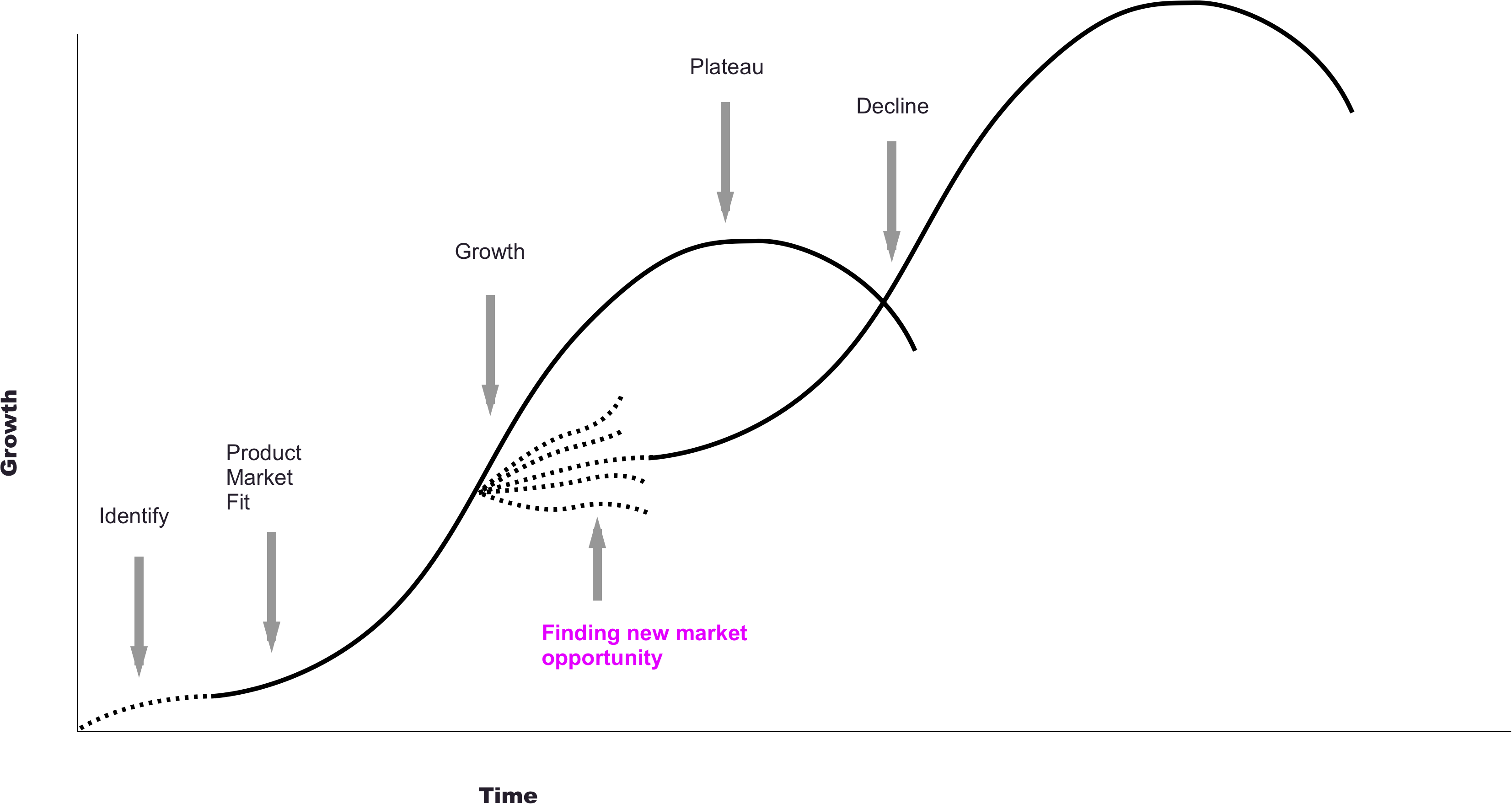

Every product and every company goes through a S-curve growth path.

- Start with exploring and identifying an opportunity

- Figure out the right offering that can achieve Product – Market fit

- Scale up to drive growth

- At some point, the growth slows down and plateaus

- Then it declines

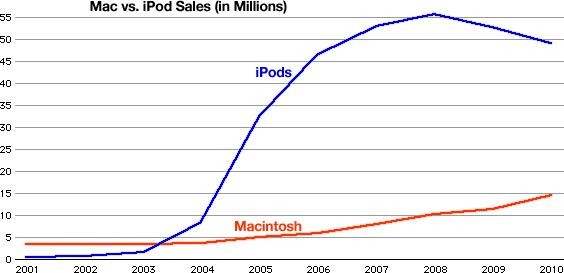

Take an example of a product like the iPod. One of the most successful products created. It went through a very steep growth and now it has been taken over by smartphones.

Notice when Apple introduced iPhone. It was in 2007, when the iPod was still growing but the growth seem to be slowing down. But for the iPhone to be released in 2007, the effort to design it and build it started several years before, when the iPod was still healthy and climbing sharply. This is critical.

The exploration of the new market opportunity needs to start without any immediate threat to existing business. It takes time and you explore many different directions before settling on one. In the case of Apple, it actually started with what became the iPad first and from there was carved into a smartphone. I am sure they explored many other directions as well.

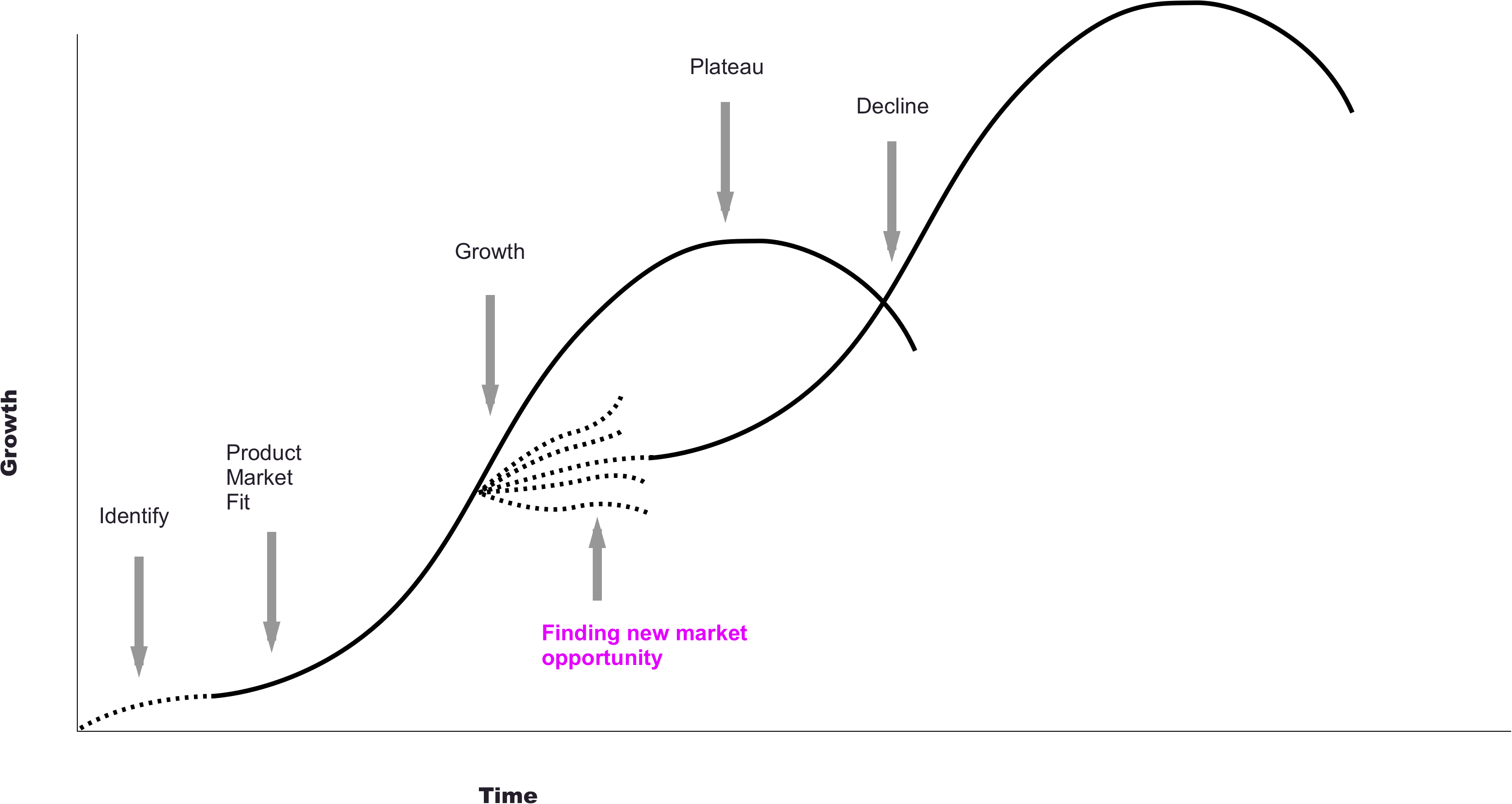

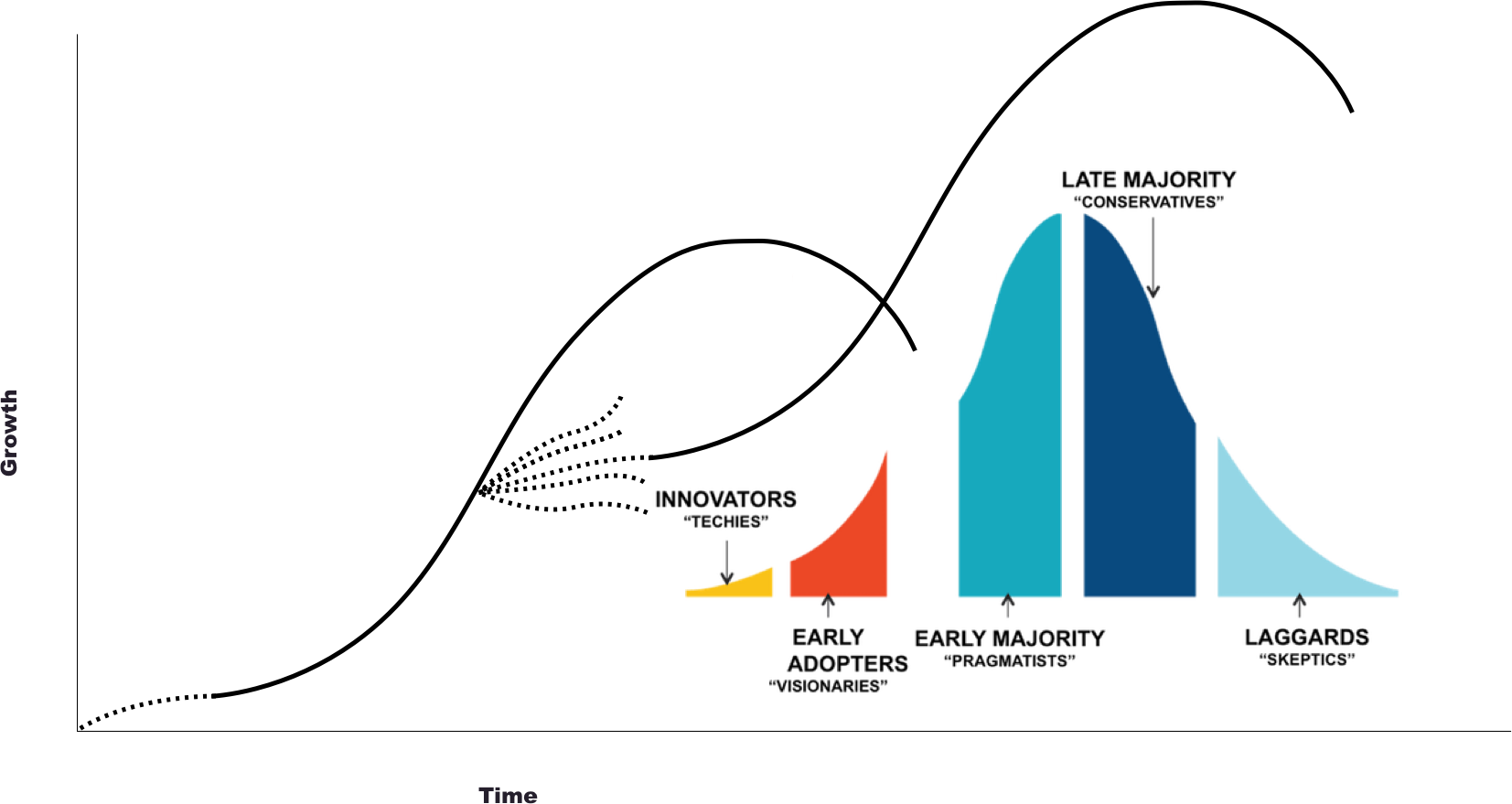

The goal is to find another market opportunity that has big enough potential (and brand alignment) and then have enough time to develop in an initial market. This is because the new S-curve starts with the same cycle of finding early adopters to gaining traction and then leading into later adopters.

How do we find new market opportunities?

The key word here is the market. You have to look at the market and understand where it is not served well. You do this by looking at people in that market (the customers) and understanding which of their needs are not being met.

This is an exploratory step but you typically have a hypothesis or a hunch, you may see trends, you may have observed something in your own experience, or seen a report, etc.

Amazon founder Jeff Bezos read a report about 2400% growth in web usage in 1994. He thought, “You know, things just don’t grow that fast. It’s highly unusual, and that started me about thinking, ‘What kind of business plan might make sense in the context of that growth?” and that drove him to found “Cadabra,” which later became Amazon.

Now you have two possible directions to go in, which will eventually merge:

- Find the right problem to solve, OR

- If you have an idea, you validate if there is a market for the idea or not

Finding the Right Problem to Solve

This works well when you have:

- Some idea of the problem space already — when you can see broad trends like telemedicine is here to stay and we are in the very early stages. There is a lot of opportunity.

- Or you have a specific market in mind — you already have a customer base for an existing product and you can expand the offering to address a different need.

At this stage, the best thing you can do is to talk to your market. I really like the jobs-to-be-done approach here. Jobs-to-be-done (JTBD) looks at the world with the lens that customers do not buy products, they hire products to get some job done. Theodore Levitt, an American economist and professor at Harvard Business School highlighted that when he said, “People don’t want to buy a quarter-inch drill, they want a quarter-inch hole.”

So the opportunity is represented by the need for the quarter inch hole. Once you know what the need is, you can figure out the market, competition and come up with an innovative solution that would differentiate.

JTBD is also interesting because it ties the customer need and their decision to hire a product for it (aka purchase decision) together. This is very beneficial to align the business and customer needs.

The process is relatively simple. You speak with people about a recently purchased process in the problem space you are interested in. For example, if you are looking at telemedicine, you would talk to people about their recent experience with a doctor. A good reference is that of a documentary – treat your conversation like a documentary. Understand not just the decision to buy or the purchase process but also the context, where was the customer, how did they know they have that need, who was with them, etc. Look at it like a story they are telling you.

Here is a useful link for more detailed info: https://jtbd.info/jobs-to-be-done-interview-template-30421972ab2a#.yk33ntw9s

Once you do such interviews with a few people you’ll start to see patterns evolve. How many people should you interview? As many as you can before you start to see some patterns. And then you’ll still continue the customer conversations – it’s an ongoing effort, not a one time thing.

I am keeping this article at a high level so I’m not getting into a very detailed step by step process. There are several techniques to analyze the data you collect from the interviews and observations. The simplest and most effective I find is simply to go through an interview transcript and create an empathy map.

Now take observations from the empathy map of each customer you researched and then group them so you can uncover patterns. Try it a few different ways and you’ll see interesting patterns evolve. These patterns represent customer needs.

From Customer to Market

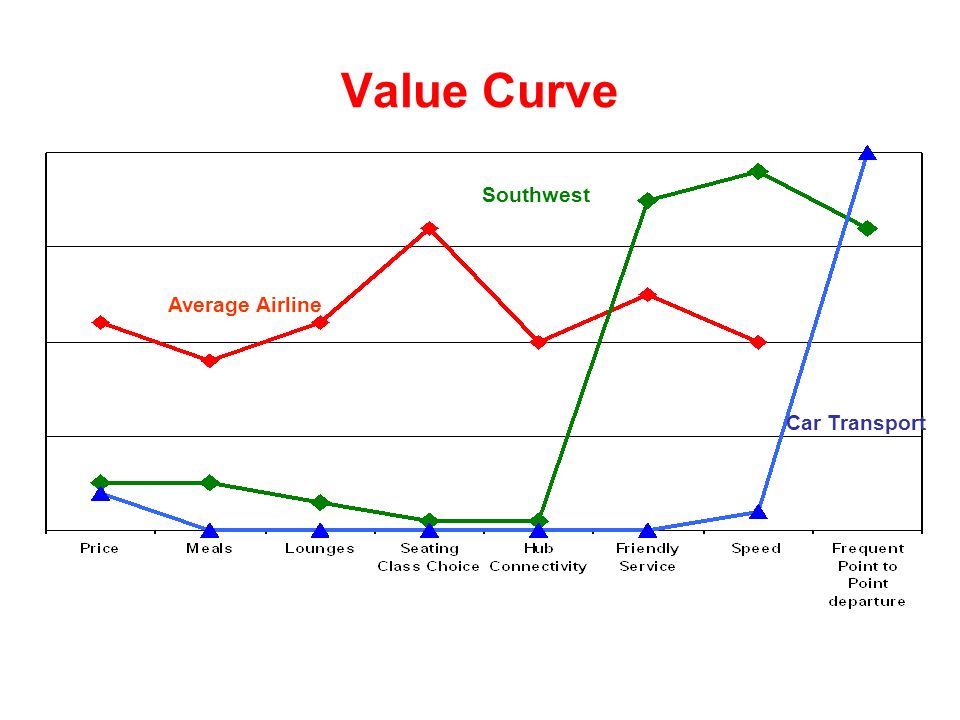

So we identified unmet needs of the customers. But the market is not just made of customers. It also includes competition. This is where I love the value curve from Blue Ocean Strategy.

The value curve is a simple but very effective tool to understand your competitive differentiation. Have is an example value curve:

Here the X-axis represents the customer needs (in the form of features/services). The Y-axis represents the strength of the solution offered. The red line represents the airlines other than Southwest and the blue line represents the cars.

A regular competitive analysis for Southwest would have compared it to other airlines. But Southwest competes with cars and other transportation options also. This is because the JTBD is to travel shorter distances and anything that helps with that becomes competition.

The second thing to notice is how different the shape of Southwest’s curve is compared to other curves. This means that it offers value in a very different way than others. This is competitive differentiation. In and of itself it does not mean a winning strategy. It would be a winning strategy only if the areas that the new product is strong at is a significant enough need for the customer.

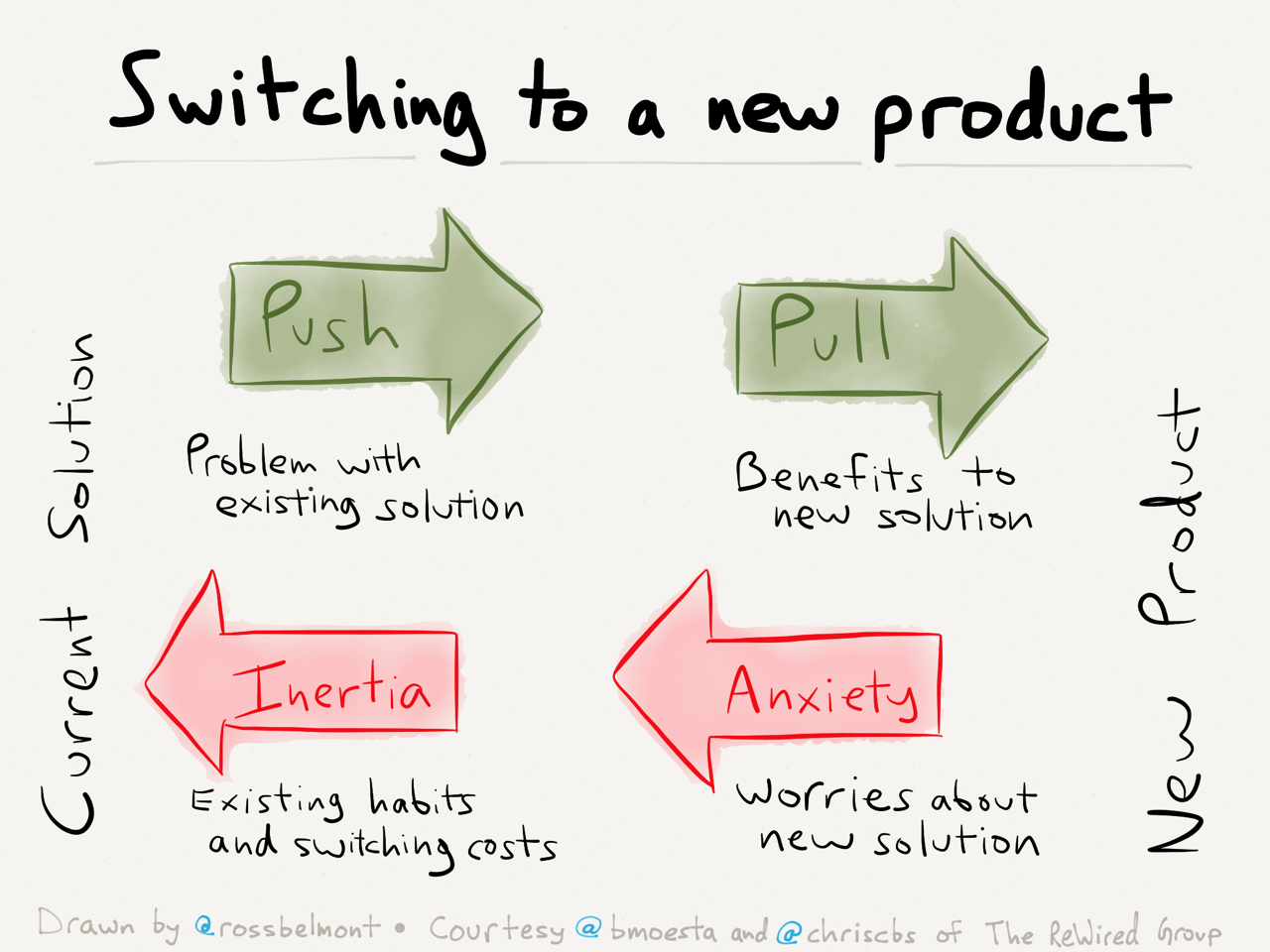

This brings us back to another wonderful and simple tool offered by JTBD. The 4 forces. JTBD has distilled a purchase decision to 4 forces. Two that push the customer away from your product and two that pull them towards. Here they are:

The stronger the forces toward new product compared to whatever the customer’s current solution is, the greater the chances of success.

Notice that we have not even started with the solution so far. We are still in the problem space, prioritizing what to focus on. This really guides our solution-ing efforts.

It’s also a good idea to validate this hypothesis about the important problems with the customers at this stage itself. This could be done through quick and dirty prototypes or surveys. This is a deep topic that I’ll try to cover in future articles. But think about how you can effectively get input from people about the importance of the needs that you have identified. Think of prototypes as visual ways of asking questions. You can do anything from role-playing a future state idea to detailed interactive prototypes. Whatever is faster and most cost-effective.

Finding Innovative Solutions

Now comes the fun part. We have identified needs that we believe represent a significant opportunity in the market. Now we can shape the solutions. A great tool to use is brainstorming sessions to bring divergent thinking. I like to use the “How might we…?” format.

How might we is a simple but very effective way to present problem statements. For example “How might we allow newly married couples to manage their finances together?”

These questions come from the JTBD research we did earlier. So “How might we help a certain type of customer get x job done?”

Gather a team of people with different background and demographics. I find a team of 8–12 people is quite effective in doing this. Have a 2–3 hour session where you pose this question to people, share some key findings from your research and then ask people to share ideas.

I like to give sticky notes to people and give them 5 minutes to come up with 30 or more ideas. (Typically I also do an icebreaker exercise — another topic for a different article.)

Here are the rules of engagement:

- Defer judgment

- Encourage wild ideas

- Build on the ideas of others

- Stay focused

- One conversation at a time

- Be visual

- Go for quantity

Do at least 2 rounds of ideation. I prefer silent ideation where each person does their own and then shares them with the group, and then people discuss and respond. A note-taker captures all of the discussion to make future analysis easier. I also like to note down the names of people against their ideas. This can help in fine-tuning brainstorming teams in future.

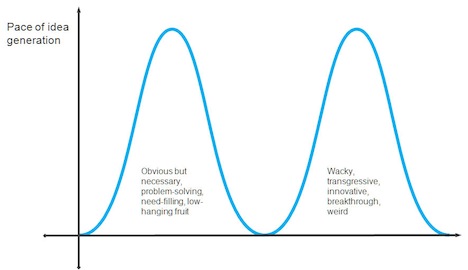

The reason for 2 or more rounds is based on something called the double hump theory, which simply means that we tend to come up with obvious ideas in the first round. Then in the second round it feels like we have peaked and won’t have any more ideas, but then we discover new and innovative ideas.

There are several techniques to help drive creative ideas, like pose extreme situation questions such as how would you solve it if you had no money or if you can only use x (some wild constraint) and so on.

Another interesting technique is call “Po” where you brainstorm on what would never be possible. This one is really powerful to challenge assumptions.Uncover solution themes

Uncover Solution Themes

A typical brainstorm can easily generate 40–50 ideas per person. So in a group of 10 people you could walk back with 400+ ideas. The ideas themselves are not necessarily the final ones, but the theme behind them is what’s most critical.

To uncover themes, we once again use affinity mapping. Affinity mapping is where you simply take the sticky notes and start to group them. This is very chaotic. It’s not easy and frankly seems impossible to be able to go through all the ideas and be able to group them. But the idea is to get started and as the groups form, people then start to add to them easily. Just bring the whole group together and allow everyone to move the stickies around. They can also move stickies out of the group or across the groups.

It’s actually a lot of fun. As the groups form, then you start to discuss them and identify what makes them a group. As you do, you continue adjust the groups and move the stickies around. Give each group a title.

Now prioritize. You can use simple dot voting where each person gets a limited number of circular sticky notes (dots) and they can place as many or as few dots on the themes they like. They could put fewer dots on a lot of ideas or a lot of dots on fewer ideas. At the end of the exercise you review the ideas that receive most votes/dots.

Instead of dot voting you can also use more involved techniques for voting where you ask people to place the themes on a scale of low to high for “the value to the customer” and then for “the ease of implementation.” From these you can pick ideas with high impact on customer and higher each of implementation. It sounds simpler than it is, but it works.

So in 2–3 hours you go from problem space to solution space, exploring 100s of ideas. Very cool (and humbling)!

Time to Prototype

Take the top themes and think how you can prototype. In addition to top themes also follow your gut. Sometime the ideas that have fewer votes are the true winners, so don’t ignore your gut feel. It is more scientific that we realize.

Prototypes don’t have to be very detailed. Here is one that I really like:

There are many ways to do prototypes:

- Role playing, like we see above

- Storytelling, where someone tells the story and other people respond

- Paper sketches – show sketches of the key moments to people and ask them to respond as if they will when the actual solution is built

- Lego prototypes – just like paper, but with Legos. This is a good option for mechanical functions

- Interactive, computer-based prototypes – you can use products like InVision, Marvel, etc. to create such prototypes quite easily. For that matter, PowerPoint or Apple Keynote can also be great software for prototyping. Whatever you are familiar with or can learn.

Hack together other products to construct yours (I don’t have the link handy but if you google how “Sprig” did their initial validation using Eventbrite, Google docs, maps and task rabbit, you’ll come out impressed).

Prototypes are only as effective as your approach in using them. Don’t treat prototypes as a way to sell your idea. Instead go with a learning mindset. Be genuinely curious, show them to people but don’t explain. Ask them to respond as they would in real life and seek to understand why they are doing or saying what they are.

Then take these learnings and tweak.

Business Model

The ideation and prototyping process we discussed is not just for the actual product, it applies to other parts of your solution also including the business model. You can brainstorm on different business models and then prototype and test those to capture customer perspective towards it.

Get to the Market

You can remain in your own controlled environment for only so long. The real test is when the product comes into the market. So find the smallest form of your product that you can bring to the market.

How small? Again, it is about learning, so define what are your biggest assumptions in making the product successful and build just enough so you can test those assumptions.

In case of Sprig, their biggest assumption initially was that they can deliver hot food in a short amount of time and that’s what they tested with the hacked together a prototype.

With this step, we have moved from exploration to the product-market fit part of our S-curve. Here is the diagram again for your reference:

Product-Market Fit

So what is product-market fit ? Imagine that you have to cook a dish for thousands of people. You need to make sure that you have a good recipe before you cook for everyone. So you make it in small quantity, taste, refine, and once you have all the proportions as you want them, you can scale and make it for those thousands of people.

This recipe formula is your product-market fit. It is the shape of your product that works in the market — both for customers and for your business.

You can only achieve this by introducing the product in the market. But introduce in a small market, just like we would make the food in smaller quantity until our recipe is in place. Going big is tempting but it’s expensive and risky for your brand. Start small, test, and as you gain traction, then scale.

Once you have achieved product-market fit, you have found your new market opportunity. It could take you anywhere from 2 to 6 months (or more in some cases) to reach this product-market fit. Take the example of Tesla – it took them a few years to reach this while Facebook had a product-market fit in its very first launch. The only way to truly know is to get your product to market.

I hope this was useful to you. Drop in a comment if you would like to add/question or discuss anything.

Recent blog posts

Stay in Touch

Keep your competitive edge – subscribe to our newsletter for updates on emerging software engineering, data and AI, and cloud technology trends.