Navigating Change: How Regional Payers Stay Ahead

Regional payers have formed the cornerstone of the US health sector, particularly within well-established commercial markets. They collectively insure ~130 million Americans, including nearly half of the employer market. Yet this position is under pressure as the needs of employers evolve and national competitors introduce new business models.

In this article, we’ll dive into the drivers of recent disruption and how some regional payers are harnessing innovative technology to reclaim their competitive advantage. I’ve had the privilege to collaborate and connect with exceptional regional plan leaders across strategy consulting roles and more recently in-house at a regional plan. I’ve also conducted numerous interviews with self-insured employers and the brokers they partner with.

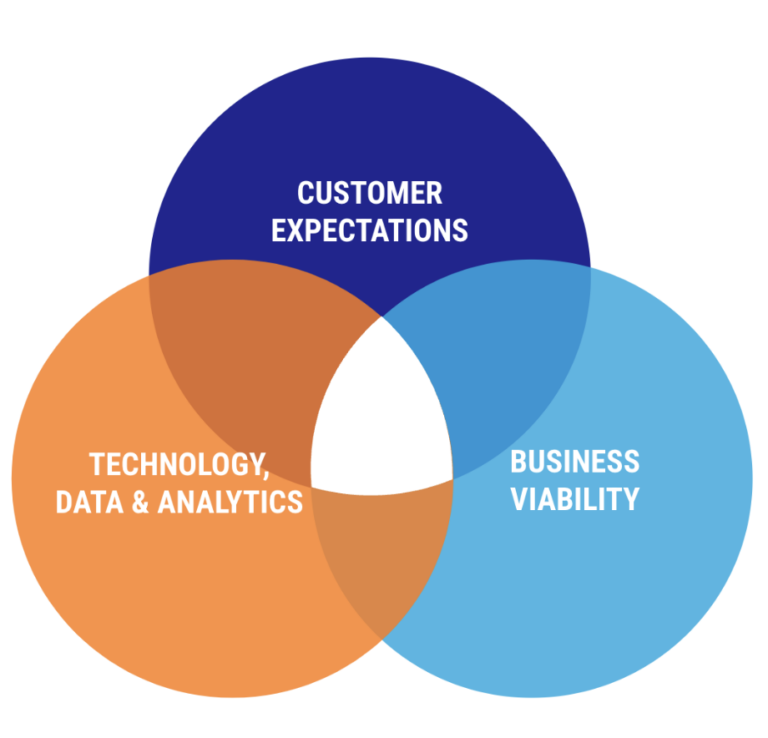

I’ve seen disruption happen at the intersection of these three forces:

Customer expectations. Do your insurance products effectively address the needs of your customers, whether employers in the commercial market of individuals on the Medicare Advantage market?

For many regional payers and TPAs, the answer is a resounding yes – and that’s precisely why they’ve maintained their presence in the industry.

The challenge, of course, is that customers’ expectations and needs evolve. They’re often influenced by experiences in other industries. Regional plans with static products risk being outpaced and disintermediated by competitors.

Business Viability. Delivering a valuable product is key, but equally important is backing it with a sustainable business model. The end of the low-interest rate era has emphasized the importance of cost-effective delivery and appropriate pricing.

As competitors introduce new pricing mechanisms and the costs associated with providing insurance shift – including developing new offerings to meet evolving needs – business models must adapt accordingly.

Technology. Is it possible to develop a profitable insurance offering that effectively caters to customer needs within the technological and operational capabilities of your organization? What will it take to build the necessary capabilities, and how does that impact the business model?

New technology is often a primary driver of disruption in health insurance, accelerating both product and business model innovation.

While regional payers initially lagged behind national counterparts in embracing the last technological paradigm shift to mobile, the current shift towards AI-enabled tools presents an opportunity for regional plans. Leveraging their deeper understanding of the local market, they can now seize the initiative and gain a competitive edge.

Section 1 – Customer preferences are shifting.

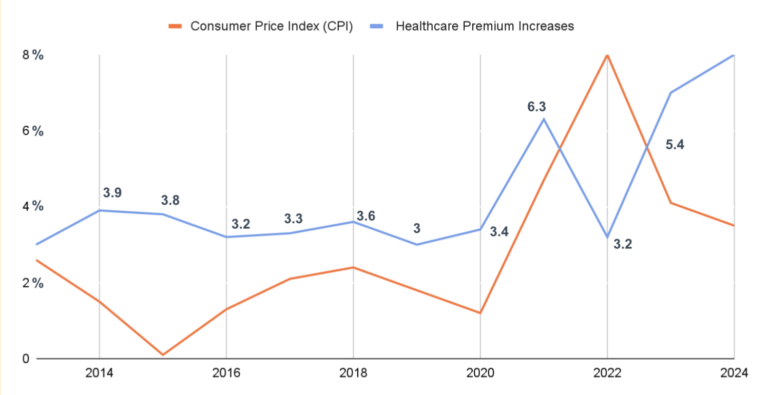

Healthcare premium increases have long outpaced inflation, even with the slowdown in growth following the ACA and shift to high-deductible plan designs.

And during the pandemic, employers were hesitant to shop around for plans. HR were preoccupied with a myriad of other tasks, and during such a challenging period it was not a good time to request employees to transition networks.

Yet coming out of the pandemic, that’s changed. Healthcare costs are rising dramatically. In Mercer, Aon, and WTW surveys of healthcare benefit leaders showed a typical premium increase in 2023 of ~6 and between 6-8% in 2024, far outpacing inflation.

On top of that, the business environment has shifted. The low-interest rate era is over and investors expect profits. That’s putting further pressure on HR leaders to reduce costs. The unsurprising outcome: plans are shopping.

“We will have more changes this year than in previous years because employers are rethinking and reevaluating their plans,” says Courtney Stubblefield, managing director of health and benefits at WTW.

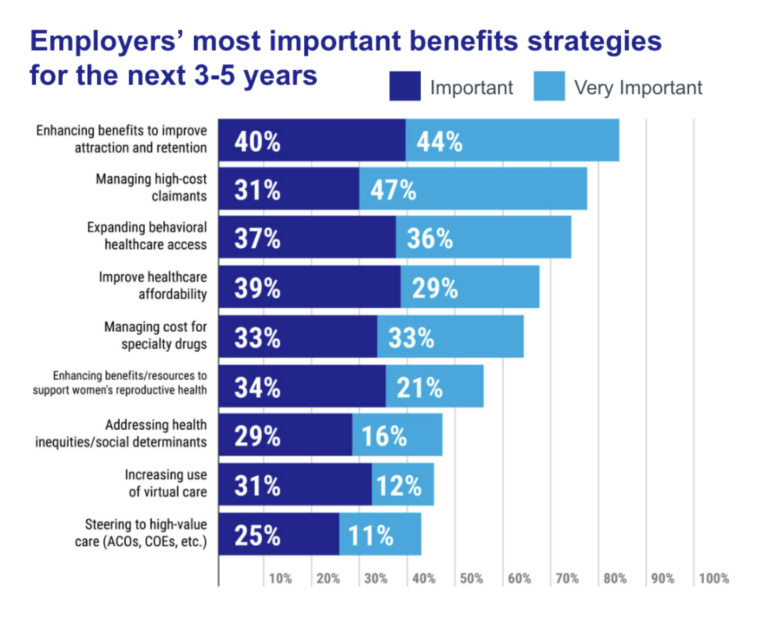

Yet along with the pressure to reduce premium growths, employers want bespoke offerings for their specific population. They face tight labor markets and need attractive benefits. In a Mercer survey of nearly 2,000 employer healthcare benefit leaders, “enhancing benefits to improve attraction and retention” was the top priority, outranking cost-focused options.

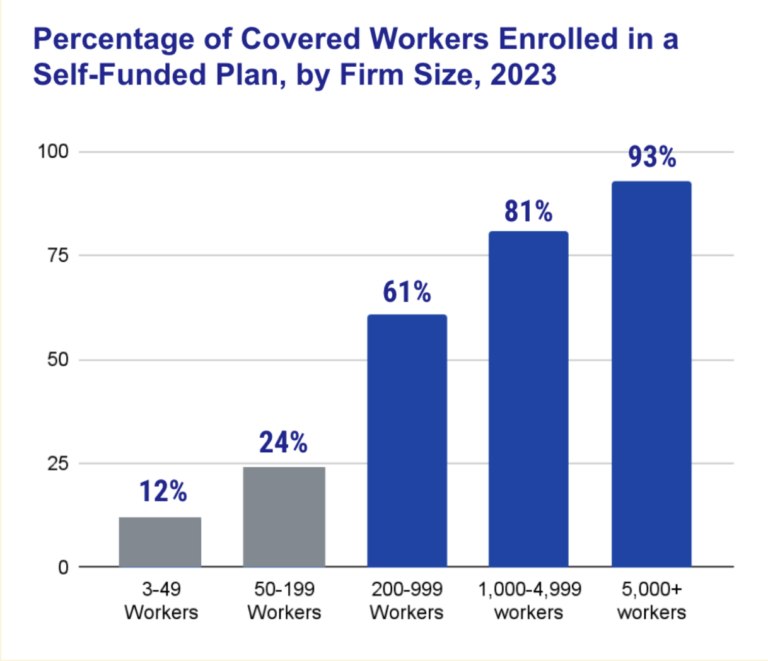

They’ve already largely shifted to self-funded plans, bearing risk to lower total spend. However this was also driven by a perception that fully-insured plans did not cater to their specific populations. Many HR leaders encroached on regional payers’ typical role, evaluating and contracting directly with digital health vendors or negotiating their own direct contacts for high-cost procedures with providers.

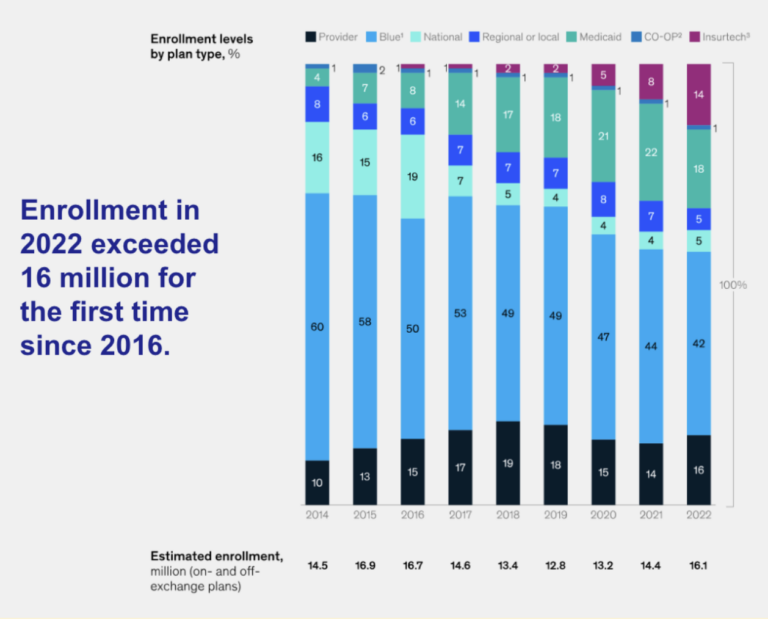

The same is true in the segments where individuals are choosing their carriers directly. Individuals want a plan that feels personalized to them. In the Individual and Family Plan (IFP) segment, regional plans have lost market share over time as insurance tech start-ups created a sense of customization for consumers, both on the product and marketing fronts.

Oscar is the most well-known disruptor in this space, though Taro Health is illustrative of the insurance product innovation that’s outpaced regional payers. They offer plans designed with bundled “free” direct primary care.

This won’t appeal to every customer and that’s the point – competitors are building a menu of insurance products that customers can choose between.

Regional payers achieved success with fully-insured products. The foundational systems built to support that legacy are now in the way of innovation. Similarly, they’re presence in multiple segments complicates network building. Constructing a narrow network tailored for the IFP market necessitates negotiations with healthcare systems that are vital partners in the commercial market.

In addition to affordability and tailor-made solutions, customers now demand simplicity. The era of point solutions is behind us. With over $100 billion invested in digital health solutions over the past decade, HR leaders are feeling the strain. They no longer have the bandwidth to sift through myriad options for diabetes management or contend with a deluge of emails from eager digital health vendors.

Don’t just take my word for it—esteemed healthcare journalist and investor Christina Farr recently articulated these sentiments in a published article.

Employers’ new expectation is that insurance companies act as their single platform partner, providing optionality for bespoke offerings while shouldering the burden of complexity.

Traditionally, insurance has operated as a platform business, with regional payers excelling in the development of robust regional networks. However, the landscape has shifted with the rise of geographically uniform, software-enabled care, with the iPhone emerging as a central tool for accessing healthcare services.

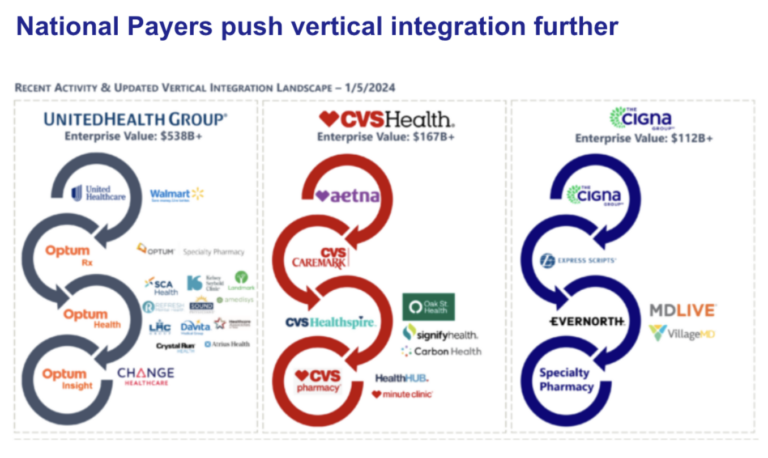

In this evolving landscape, large payers have the upper hand, as they construct vertically integrated care ecosystems that seamlessly blend traditional local in-person services with software-enabled Pharmacy Benefit Managers (PBMs), specialty pharmacies, chronic condition management, and behavioral health solutions.

This push for simplicity won’t go away any time soon. Consumers want the convenience and simplicity that well-build software products give them in other industries.

Section 2 – Business Models are under pressure

These shifts from customers introduce new business model challenges. How to deliver on the expectations for competitively priced, customized, and administratively simple insurance products

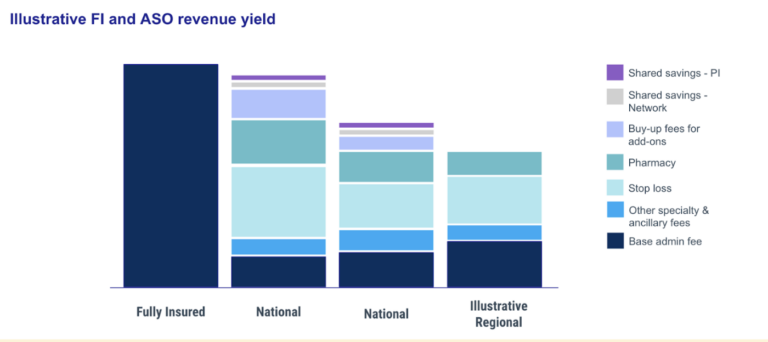

Consider employers’ shift from fully-insured products to Administrative Services Only (ASO). The vast majority of employers with more than 200 employees are now self-insured. This has put serious financial strain on regional plans, who’s fully insured commercial products account for the majority of their business. The fees paid on ASO plans are significantly less than the net revenue on fully insured products.

National payers have met this challenge by building tech stacks that can host highly configurable products, paired with innovative pricing strategies.

They typically offer much lower baseline administrative feeds for administrative services than their regional payer competitors. However they then build back the revenue they had on fully insured products by offering compelling “add-on” purchases for employers. Beyond stop loss insurance and integrated PBM services, the national payers offer chronic condition management services, specialty pharmacy services, wellness programs, EAP services, etc.

Critically, the employer chooses the benefits that appeal to their specific populations. The young tech company can opt for the fertility benefits solution into their solution. The company with a solidly middle-aged workforce struggling to aid aging parents can add on caregiver support programs.

But this product and pricing approach requires tech capabilities far different from a fully insured product where each member has the same benefits. Systems must account for not just plan design but also the network each group can access (inclusive of digital-only programs), and facilitate the coordination between what will be a unique combination of services for each self-insured employer.

Of course, national payers have held the advantage when it comes to this new approach to insurance products, which necessitates building software. They’ve benefited from economies of scale, bringing in outside help (like 3Pillar) to build great software products and complement internal product, design, and engineering teams. For instance, one of our payer clients brought us in to build the core member-facing portal used by 30 million of their customers.

Plans like UHG have also been able to quickly expand ASO functionality through acquisitions. With $22B in profits in 2023, they are able to invest at a scale regional plans cannot. A different strategy/approach is needed.

Section 3 – New technology tools to the rescue.

Regional plans’ are well positioned to respond to these challenges, though. They can draw on assets that give them significant advantages over national plans:

- Brands. Employers, providers, and members know regional payers’ brands and have far more positive associations with them than the national brands. Locally-focused philanthropic giving

- Distribution. These local plans tend to have close knit relationships with the brokers and benefit consultants serving local employers. They live in the same communities, belong to the same regional organizations, etc.

- Customer and stakeholder relationships. Similarly, regional plans have access to local employers and providers to solicit feedback and co-develop new products. There’s a level of trust there that regional payers should harness as they develop new offerings.

- Data and institutional knowledge. Finally, regional plans know more about the provider and employee landscape than any national player. And regional payer employees have more institutional knowledge about the peculiarities of the healthcare business in a regional market than any other industry.

Regional plan leaders and their teams know what needs to change to deliver better care and drive the business forward.

The challenge is that in 2024 any change requires building or adapting digital products and infrastructure. This is what holds them back from innovating. Internal systems were built for fully-insured products and are difficult to adapt. The data infrastructure is fragmented. Integrations with 3rd party vendors are difficult.

Fortunately the tech paradigm is changing. The agonizing “build or buy” decision of the past is giving way to new “buy to build” platforms. There are new tools that allow regional plans to quickly modernize applications, build new workflows, and create data and intelligence layers. They allow the small product and engineering teams at regional payers to have an outsized impact.

I detailed these new technologies and how health care orgs are beginning to use them in the post Healthcare Innovation Requires Deliberate Action, Not More Strategy.

3Pillar helps health plans think through how to best deploy these new technologies. We also deploy teams of engineers, product managers, and designers to work alongside regional payers’ tech teams and business leaders. For example, we’ve partnered with a dominant regional plan for the past 15 years, helping them upgrade key systems including building a data warehouse and upgrading claims processing system as well as build new broker and provider-facing digital products.

I joined 3Pillar after seeing regional plans move forward with smart strategies and new solutions only to get bogged down by old tech systems. The tools and help to upgrade your systems in order to adapt to the market exist. Happy to connect and, if helpful, make an intro to one of our Field CTOs who have been leading this work with our healthcare clients.

About the author

Recent blog posts

Stay in Touch

Keep your competitive edge – subscribe to our newsletter for updates on emerging software engineering, data and AI, and cloud technology trends.